What insurance do builders need?

1st June, 2018

Having a robust Builders Insurance policy in place should form part of your business’ foundations in which you can build on, knowing it is fully protected.

Having placed Builders Insurance across Nottinghamshire, Derbyshire and the rest of the UK for over 50 years, we know exactly what insurance cover your business needs.

Your policy should comprise:

Essential cover

- Public Liability - Protects third-party injuries and property damage whilst work is carried out on a property

- Employer’s Liability - A legal requirement for limited companies that employ one or more people, insuring all parties involved in the project should they be injured or become ill as a result of their work

- All Risks – Comprehensive cover for all types of construction project, offering protection against loss or damage

- Commercial Vehicle – It is important to ensure your vehicles are covered for your work tasks and not just for personal use.

Highly-desirable cover

- Professional Indemnity – Designed to protect builders against the financial impact of claims of negligence by meeting the amount of compensation you may need to pay

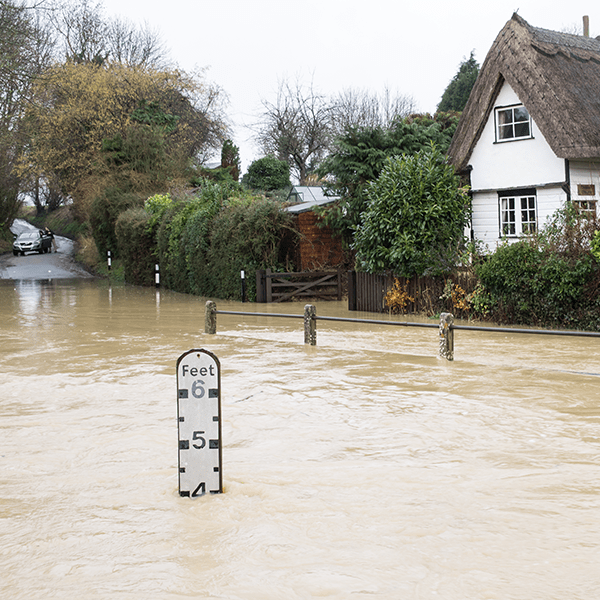

- Business Interruption – A type of insurance that covers the loss of expected income that a business premise may suffer after a disaster

- Plant and Machinery – This policy covers contractors' plant, from powered equipment to hand tools, from damage and theft

- JCT – Cover for works carried out on all types of property.

Additional cover worth considering

- Legal Expenses – This insurance covers costs related to compensation that needs to be paid, employment disputes, compliance, tax investigations and more

- Personal Accident – Cover for costs that arise from the inability to work full-time after an injury or illness.

Find out more about Builders Insurance here.

If you are unsure whether your Builders Insurance fully protects your business, get in touch with a member of the team who will review your requirements.